The current market cycle is defined by a distinct rotation: capital is moving from speculative assets into critical infrastructure. While meme coins dominate social media volume, on-chain data reveals that ‘smart money’ is increasingly positioning itself in the rails that will carry the next generation of decentralized finance (DeFi).

Bitcoin remains the undisputed king of crypto, but let’s be honest, its utility has historically been capped by technical limitations. The network is secure, yes, but slow. While the Lightning Network attempted to solve payments, the broader issue of programmability remains. Institutions are watching this gap. Unlocking even 1% of Bitcoin’s dormant capital for decentralized applications represents a trillion-dollar opportunity.

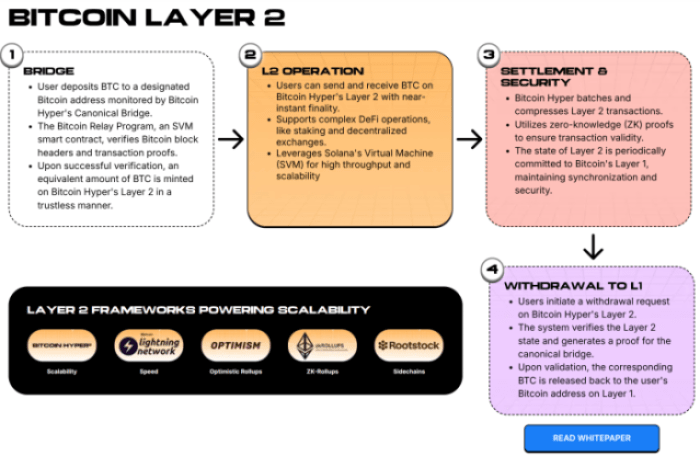

The future isn’t about whether Bitcoin will recover and how high it climbs again. It’s about turning it from a place where Bitcoin isn’t just a store of value, but the settlement layer for a bustling ecosystem of high-speed applications. This structural shift is directing liquidity toward Layer 2 solutions that promise to modernize the network without compromising security.

Bitcoin Hyper ($HYPER) is capitalizing on this demand, effectively merging the speed of Solana with the security of Bitcoin. This makes it one of the best crypto to buy.

Solving The Scalability Trilemma With SVM Integration

The main driver here is the ‘Scalability Trilemma,’ the challenge of achieving speed, security, and decentralization all at once. Most Bitcoin layers sacrifice performance for security. The result? Sluggish user experiences that fail to retain retail users. Bitcoin Hyper addresses this by integrating the Solana Virtual Machine (SVM) directly into a Bitcoin Layer 2 framework.

That matters because the SVM is currently the gold standard for high-throughput execution. By using this architecture, Bitcoin Hyper delivers sub-second finality and negligible transaction fees, a stark contrast to the costly execution found on traditional Ethereum-based L2s or the mainnet itself. It’s not just a technical upgrade; it’s a user experience revolution.

It lets developers build complex dApps, such as high-frequency trading platforms and interactive gaming, using Bitcoin’s robust liquidity as the settlement layer.

From a development perspective, this modular approach, using Bitcoin L1 for settlement and a real-time SVM L2 for execution, lowers the barrier to entry. Developers can use Rust to build applications that feel as fast as Solana but settle on the world’s most secure blockchain. Plus, the decentralized Canonical Bridge reduces friction, allowing for seamless $BTC transfers. Want a full project play-by-play? Check out our ‘What is Bitcoin Hyper ($HYPER)?‘ guide.

For investors, the value proposition is clear: infrastructure that eliminates bottlenecks captures value.

EXPLORE THE $HYPER ECOSYSTEM

Smart Money Flows Favor Early-Stage Infrastructure

Technical architecture provides the thesis, but on-chain flows provide the timing. Traders often look for divergences between price action and capital accumulation. In the case of Bitcoin Hyper ($HYPER), the funding data indicates significant demand for this infrastructure-focused approach.

$HYPER has already raised over $31M. That figure underscores strong conviction from early backers. With tokens currently priced at $0.0136753, the entry point reflects an early valuation relative to established Layer 2 competitors like Stacks. The sheer volume suggests the market is validating the ‘SVM on Bitcoin’ thesis before the mainnet is fully saturated.

Crucially, high-net-worth individuals are already taking positions. Smart money is moving. Etherscan data shows that during the presale, whales have bought up over $1M, with the largest purchase totalling $500K. Whale accumulation during a presale phase is a notable signal; it implies that sophisticated actors are locking in supply, anticipating a supply shock post-TGE.

Plus, the protocol’s decision to offer high APY staking immediately after the Token Generation Event (TGE), with a short 7-day vesting period for presale stakers, incentivizes long-term holding over short-term flipping.

$HYPER isn’t competing with $BTC; it’s lifting it up to what it can be, maximizing its potential.

BUY YOUR $HYPER FROM THE OFFICIAL PRESALE PAGE

The content provided in this article is for informational purposes only and does not constitute financial advice. Cryptocurrency markets are volatile, and presale investments carry inherent risks. Always perform your own due diligence before investing.